Latest Articles

An arts background

Despite best intentions (and a successful career in other fields), it was somewhat inevitable that Dunedin-born Andrea Hotere, daughter of award-winning poet Cilla McQueen and one of the country’s most significant artists, the late Ralph Hotere, ended up writing a novel about art.

Hidden gems

From grand Old Masters to significant contemporary works by Ngāi Tahu artists, a very special collection of pieces from the Dunedin Public Art Gallery are now on display for the first time as part of recently opened exhibition Huikaau – where currents meet.

Cook your own way

Much-loved MasterChef NZ winner Sam Low shares his deliciously unique food journey, as well as three moreish recipes from his cool new cookbook Modern Chinese.

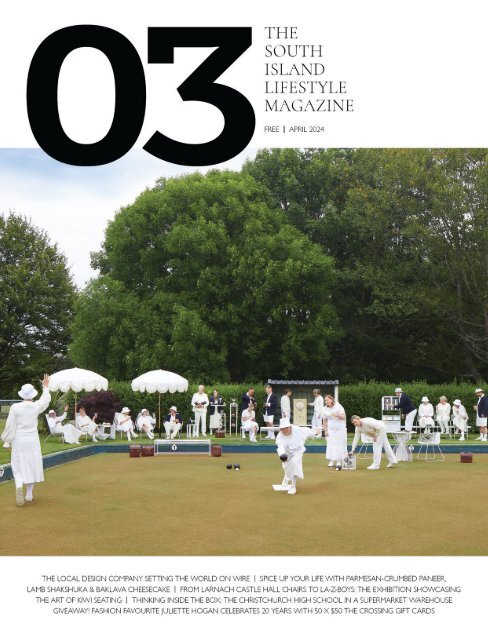

Fun in the sun

Wear summer on your sleeve with shades of sky blue and sunshine yellow, make a splashin resort-ready florals or chill out with tropi-cool accessories.

A secret garden

The first in a series of extracts from gorgeous new gardening tome Secret Gardens of Aotearoa, we travel to Central Otago’s lake district to see the magic Ali Soper has worked on a very special 113-year-old former sheep station.

Book club

Great new reads to please even the pickiest of bookworms.

Bringing the drama indoors

Inspired by its dramatic surrounding landscapes, this new Queenstown build showcases rich raw texture, organic forms and lashings of modern, moody hues.

Most wanted

From pavlova-scented candles and lamington-hued mugs to much-anticipated

autobiographies, vintage-inspired jewels, chequerboard towels, quirky tees and cut crystal, here’s what 03’s editor is coveting right now.

Designer holidays

We check in with some of New Zealand’s most-loved designers on their oh-so-stylish holiday plans, what they’ll be wearing and what their customers (including here in the south) are looking to now for the long Kiwi summer.

About face

From sought-after sheet masks and heavenly hand serums to sun-kissed skin tints and powerfully good SPFs, here’s what the 03 team are testing right now.

An all-in good time

Having just thrown open the gates to Ayrburn, the 60-hectare, $200 million development set on a 160-year-old estate near Arrowtown, visionary Chris Meehan talks us through what to expect from the brand-new-but-also-historic precinct that’s shaping up to be unlike anything else on offer in Aotearoa.

Interview Josie Steenhart

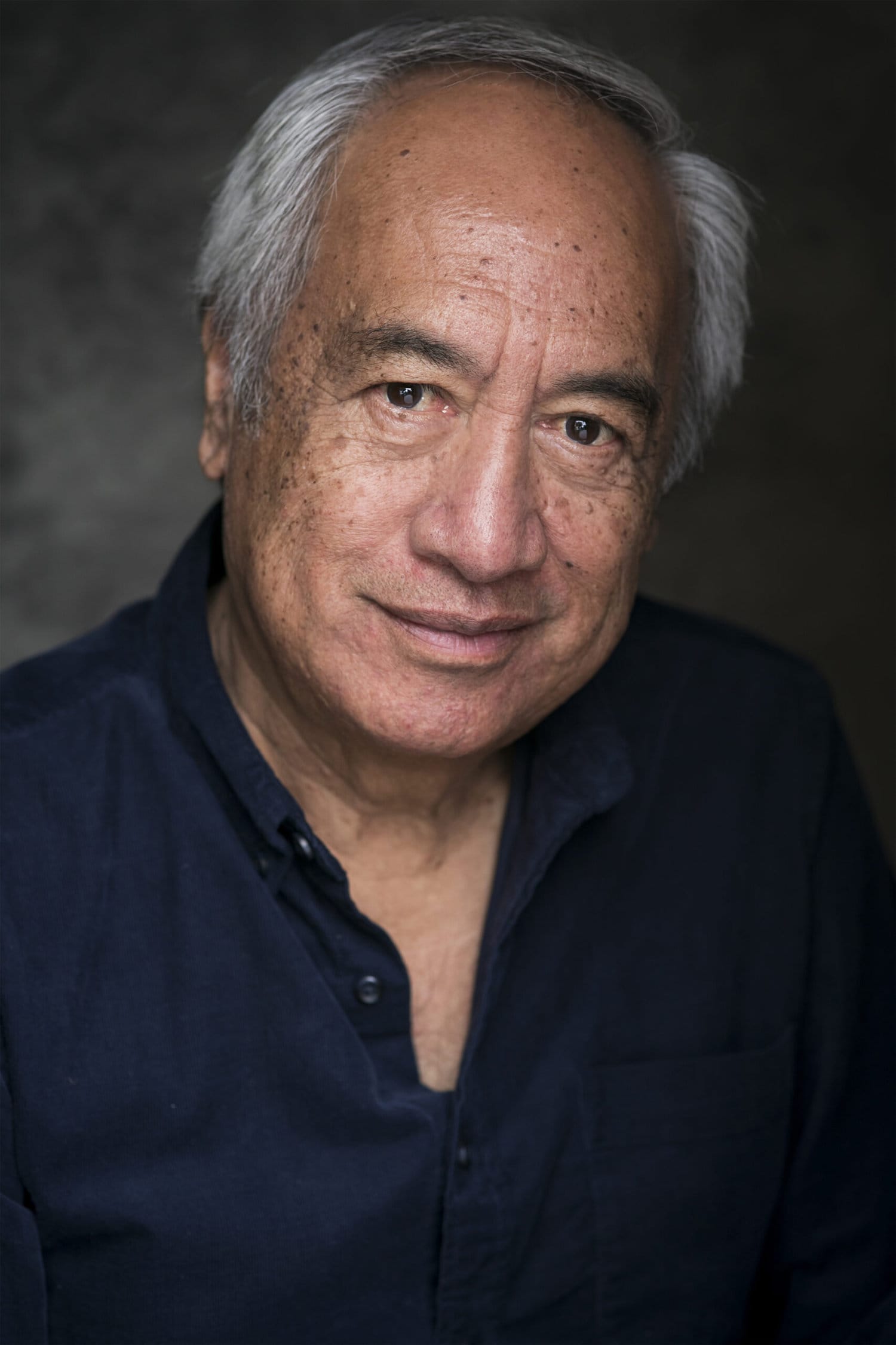

A national taonga

Fifty years ago this year, Witi Ihimaera published his debut novel, Tangi, the first novel by a Māori author. Tom McKinlay caught up with the celebrated writer on the eve of his visit to Dunedin for the city’s Readers & Writers Festival.

Read Me

Follow us on Instagram

Follow us on Facebook

This message is only visible to admins.

Problem displaying Facebook posts. Backup cache in use.

Problem displaying Facebook posts. Backup cache in use.

Error: The user must be an administrator, editor, or moderator of the page in order to impersonate it. If the page business requires Two Factor Authentication, the user also needs to enable Two Factor Authentication.

Type: OAuthException

Type: OAuthException

Sign up to receive our newsletter